If you want to become a real estate agent in Minnesota, you must first obtain a license. Your Minnesota real estate license can usually be obtained within two months depending on how quickly you complete it. The process can be completed online or in person. Before you start the journey, however, you need to be aware of what you're up against.

To obtain your Minnesota license as a real estate agent, you must be at 18 and a citizen of the United States. A number of courses will be required in addition to fulfilling all legal requirements. The courses required 90 hours of prelicensing training, which must take place at an accredited school. Additionally, you must pass a licensing exam and earn at least 15 continuing education (CE) credits per year. Each of these items must be completed by June 30 of each year.

There are many courses to choose from. Some courses can be taught in a classroom, while others are online. These courses can be an excellent choice for those who are looking for something more convenient. Many online classes can be viewed livestreamed, so you can ask questions in class. Taking a live course also gives you the chance to meet other students and ask questions in real time.

When deciding on which course to take, you'll want to consider the length of time it will take you to complete the course. It's best to pick a course that will allow you to finish the course in two months or less. You will be able to complete the course in as little as two months with an online course.

To begin the process, you will need to find an agent to sponsor your application. Additionally, you will need to provide some personal data. Once you have found a broker you can submit your application to Minnesota Real Estate Commission.

Once you've submitted your application, you will need to pay a fee to the state. The fee covers both the technology surcharge as well and the real education fund. Your broker will then process and print your Minnesota realty license.

It is a smart idea to spend some time researching before you begin preparations for your licensing exam. It is important to prepare for everything, from the testing center to taking the actual exam. Many companies offer preparation courses for exam success. CE Shop offers a Minnesota-specific Exam Prep program.

Your ability to dedicate enough time to your studies will determine how quickly you can complete your prelicensing programs. In fact, a few of the companies mentioned in the article above offer packages that cover the whole process. The process can be completed by a full-time student in two months. It's important to prepare for the exam.

FAQ

How do I fix my roof

Roofs can become leaky due to wear and tear, weather conditions, or improper maintenance. Minor repairs and replacements can be done by roofing contractors. For more information, please contact us.

What are the top three factors in buying a home?

Location, price and size are the three most important aspects to consider when purchasing any type of home. The location refers to the place you would like to live. Price refers how much you're willing or able to pay to purchase the property. Size refers to the space that you need.

What should I do before I purchase a house in my area?

It depends on how much time you intend to stay there. Save now if the goal is to stay for at most five years. But, if your goal is to move within the next two-years, you don’t have to be too concerned.

What are the disadvantages of a fixed-rate mortgage?

Fixed-rate loans tend to carry higher initial costs than adjustable-rate mortgages. Also, if you decide to sell your home before the end of the term, you may face a steep loss due to the difference between the sale price and the outstanding balance.

Should I use a broker to help me with my mortgage?

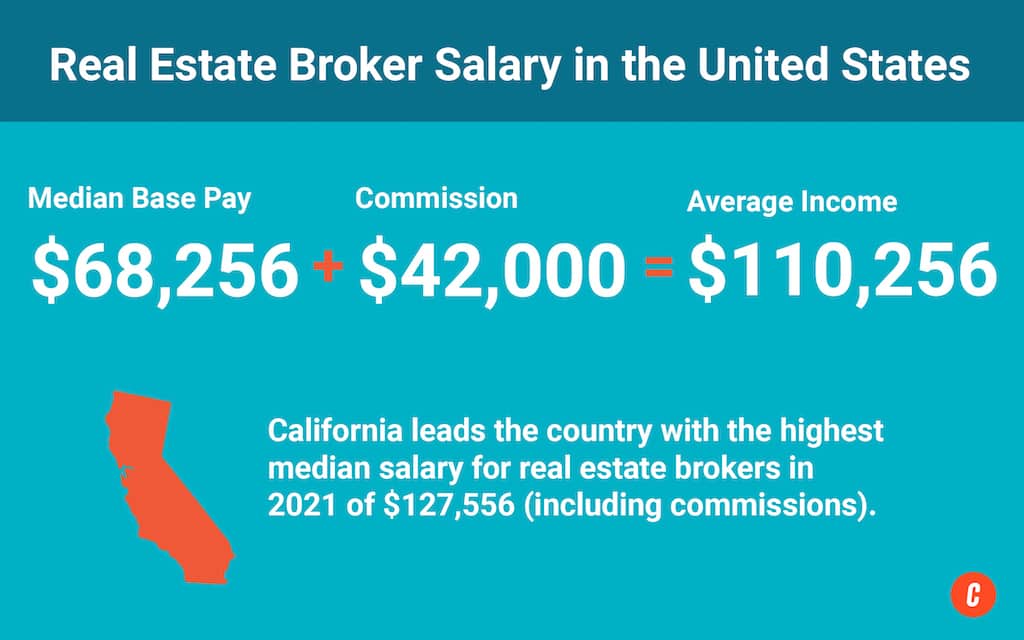

Consider a mortgage broker if you want to get a better rate. Brokers can negotiate deals for you with multiple lenders. Brokers may receive commissions from lenders. Before you sign up, be sure to review all fees associated.

What is the average time it takes to sell my house?

It all depends on several factors such as the condition of your house, the number and availability of comparable homes for sale in your area, the demand for your type of home, local housing market conditions, and so forth. It may take 7 days to 90 or more depending on these factors.

What should I consider when investing my money in real estate

The first step is to make sure you have enough money to buy real estate. If you don’t save enough money, you will have to borrow money at a bank. You also need to ensure you are not going into debt because you cannot afford to pay back what you owe if you default on the loan.

You should also know how much you are allowed to spend each month on investment properties. This amount must cover all expenses related to owning the property, including mortgage payments, taxes, insurance, and maintenance costs.

You must also ensure that your investment property is secure. It would be best to look at properties while you are away.

Statistics

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

External Links

How To

How to purchase a mobile home

Mobile homes are homes built on wheels that can be towed behind vehicles. They have been popular since World War II, when they were used by soldiers who had lost their homes during the war. People who live far from the city can also use mobile homes. These houses are available in many sizes. Some are small, while others are large enough to hold several families. You can even find some that are just for pets!

There are two types main mobile homes. The first is built in factories by workers who assemble them piece-by-piece. This process takes place before delivery to the customer. You could also make your own mobile home. Decide the size and features you require. Next, make sure you have all the necessary materials to build your home. To build your new home, you will need permits.

These are the three main things you need to consider when buying a mobile-home. You might want to consider a larger floor area if you don't have access to a garage. Second, if you're planning to move into your house immediately, you might want to consider a model with a larger living area. Third, you'll probably want to check the condition of the trailer itself. If any part of the frame is damaged, it could cause problems later.

Before buying a mobile home, you should know how much you can spend. It is important to compare prices across different models and manufacturers. Also, look at the condition of the trailers themselves. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

An alternative to buying a mobile residence is renting one. Renting allows you the opportunity to test drive a model before making a purchase. Renting isn't cheap. The average renter pays around $300 per monthly.