What happens when a contract for real estate expires

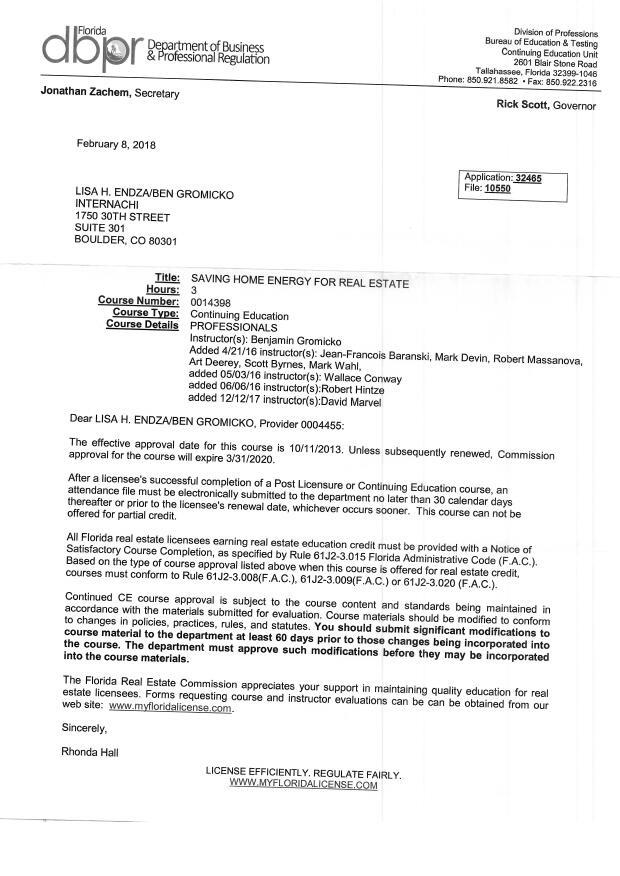

A realty contract is a legal agreement between buyers and sellers that specifies the terms of a sale. Although it can seem complicated, it is important to know what to expect and what you should do in the event of a dispute.

1. Protection Clause Real Estate

The protection period in your contract should be included if your home is being sold by a real estate agent. The protection period protects your agent from losing their commission if someone else buys your home before your contract expires.

This clause is typically included in the listing agreement. Make sure to understand it. The protection period could last as long as one year, or as short as several weeks depending on the details.

2. The Protection Period Can Work In Your Favor

Before you sign your contract, a good agent will explain to you how the protection clause works. They should also tell you how much you'll have to pay to the buyer's agent if you sell your home within this time frame.

3. The Extender Clause Can Cause Problems

An extender clause can be assigned to property listed through a broker. The clause states that the listing will continue beyond the expiration. If the extension is made within the protected timeframe, this can lead to problems.

4. The Protection Clause is Reinterpreted

There is always a possibility that a contract in real estate could be read differently to what you believe it is. Sometimes this can lead either to legal disputes between your agent and you or between you as the buyer.

5. It's possible to cancel an offer on your home if you have already used it.

Many buyers submit offers which are not accepted before the offer expires. This can be a frustrating experience, especially if you're trying to get your house sold fast.

It is possible to avoid this by sending an offer with a deadline that the seller must respond to. This allows you pressure the seller into accepting the offer before it expires.

You may need to negotiate with the seller in this instance to determine if they are willing to negotiate a lower price or if it is possible to continue your life without having to sell your home.

6. You and your agent can review the offer

You and your agent should have a dialogue if you aren't satisfied with the outcome to your real estate transaction. Your agent knows the market in your area and the competition.

7. You and a lawyer can review the offer

An agreement is required for anyone involved in a real-estate transaction. This agreement contains information about the sale such as the price and the closing date.

A buyer's lawyer will review any purchase agreement to ensure it has all necessary details. You might be able offer suggestions or modifications that will improve the transaction.

FAQ

What is the average time it takes to sell my house?

It depends on many different factors, including the condition of your home, the number of similar homes currently listed for sale, the overall demand for homes in your area, the local housing market conditions, etc. It may take 7 days to 90 or more depending on these factors.

Is it possible fast to sell your house?

If you plan to move out of your current residence within the next few months, it may be possible to sell your house quickly. However, there are some things you need to keep in mind before doing so. You must first find a buyer to negotiate a contract. Second, you need to prepare your house for sale. Third, advertise your property. Finally, you should accept any offers made to your property.

What is the cost of replacing windows?

Replacement windows can cost anywhere from $1,500 to $3,000. The total cost of replacing all your windows is dependent on the type, size, and brand of windows that you choose.

Statistics

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- 10 years ago, homeownership was nearly 70%. (fortunebuilders.com)

- This seems to be a more popular trend as the U.S. Census Bureau reports the homeownership rate was around 65% last year. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to become real estate broker

An introductory course is the first step towards becoming a professional real estate agent. This will teach you everything you need to know about the industry.

The next thing you need to do is pass a qualifying exam that tests your knowledge of the subject matter. This requires that you study for at most 2 hours per days over 3 months.

This is the last step before you can take your final exam. You must score at least 80% in order to qualify as a real estate agent.

If you pass all these exams, then you are now qualified to start working as a real estate agent!