There are many benefits to renting out a property. This article discusses the advantages and disadvantages of doing this. It also addresses financing options. Private mortgage loans are one option, but there are many other options. In addition, you can work with a local real estate agent to get advice on the market and the property.

Investing in a rental property outside of your state

Investing in rental properties outside your home state can be a great idea. People who live in costly areas may find cheaper properties elsewhere. This can lead to greater profits for the investor. Investing in rental properties outside your state can also help you diversify your portfolio.

Another reason to rent properties in other states is the geographic diversity. This is a great advantage as it allows you to diversify and protect your portfolio from devastation in one area. Each state, town, and county is unique so the impact of a market downturn in one location may not be the same for another.

Challenges

The process of renting out property can be complex if you're thinking about buying it. Although out-of-state markets may offer higher profits, it is worth spending more time to understand the area. For the best results, research the area online.

If you are looking to diversify the real estate portfolio, it is a smart decision to buy property out-of state. However, it is time-consuming and expensive.

Rewards

Out-of-state rentals can offer many benefits. It diversifies your rental portfolio, and reduces the chance of total destruction in one location. Second, every state and each county has its own economy. This means that a decrease in one region may not have an impact on the markets in other areas.

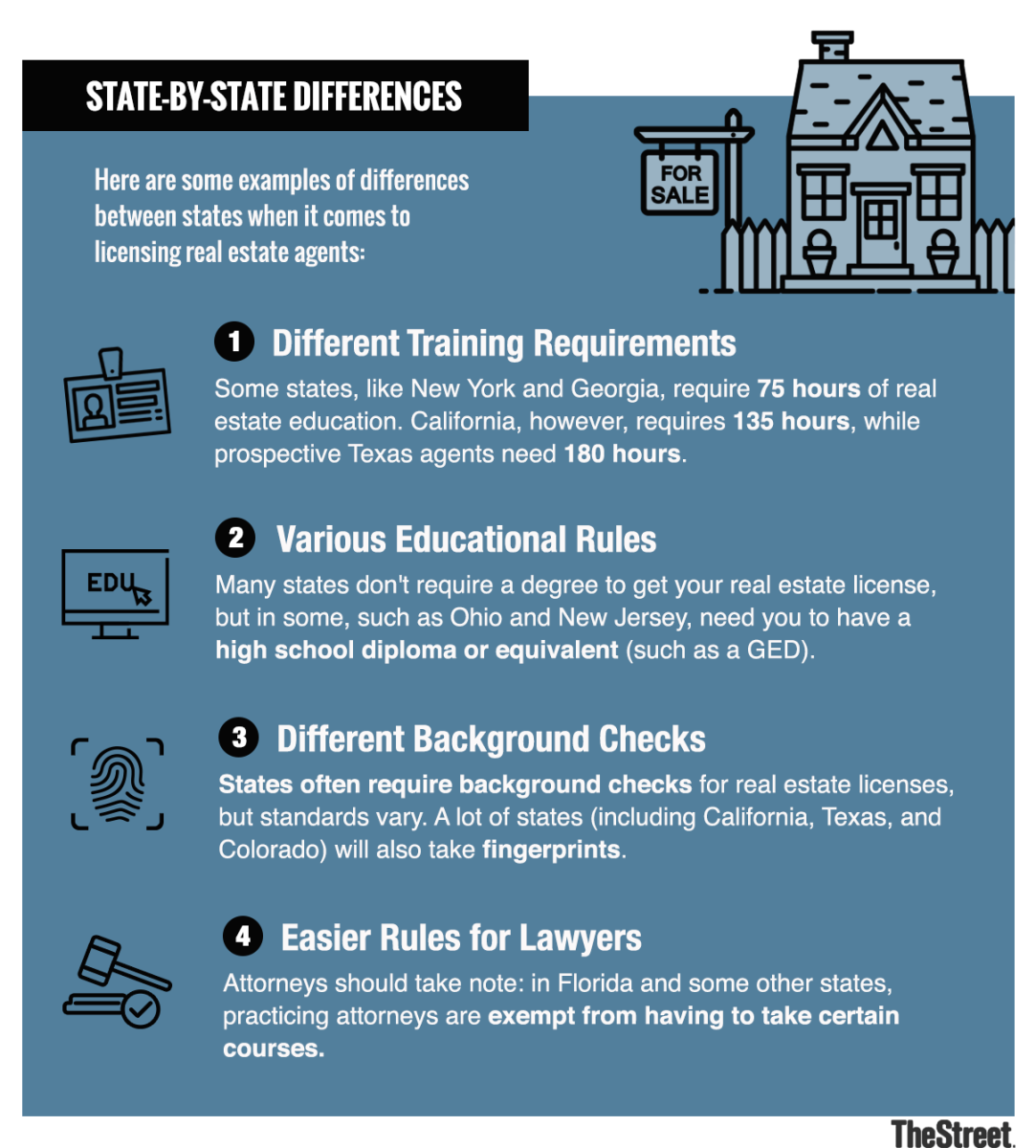

Additionally, renting out of the state can diversify an investor portfolio and provide passive income. Renting out your property is a risky business. You will find different laws governing landlord and tenant relations in each state. These laws may affect the screening of tenants, as well as how rent increases or decreases.

There are many financing options

In order to get financing for your investment in rental property, you will need to make additional arrangements. The best way to avoid these pitfalls is to research your financing options and get pre-approved before looking at properties. This will allow you to quickly find the right property and avoid any surprises.

A second option is to approach a bank or lending institution. A bank or lending institution will be more lenient if you have an established track record as a landlord and can show that you're a good risk. Typically, a downpayment of at least twenty five percent is required. This will reduce your debt-to income ratio and allow for lower interest rates.

FAQ

Do I need flood insurance?

Flood Insurance covers flooding-related damages. Flood insurance protects your belongings and helps you to pay your mortgage. Learn more about flood insurance here.

How can I determine if my home is worth it?

You may have an asking price too low because your home was not priced correctly. If your asking price is significantly below the market value, there might not be enough interest. You can use our free Home Value Report to learn more about the current market conditions.

How much will my home cost?

It all depends on several factors, including the condition of your home as well as how long it has been listed on the market. The average selling price for a home in the US is $203,000, according to Zillow.com. This

Can I get a second loan?

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is usually used to consolidate existing debts and to finance home improvements.

How many times can I refinance my mortgage?

This depends on whether you are refinancing with another lender or using a mortgage broker. In either case, you can usually refinance once every five years.

Statistics

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Based on your credit scores and other financial details, your lender offers you a 3.5% interest rate on loan. (investopedia.com)

- When it came to buying a home in 2015, experts predicted that mortgage rates would surpass five percent, yet interest rates remained below four percent. (fortunebuilders.com)

- The FHA sets its desirable debt-to-income ratio at 43%. (fortunebuilders.com)

External Links

How To

How to purchase a mobile home

Mobile homes are houses that are built on wheels and tow behind one or more vehicles. Mobile homes were popularized by soldiers who had lost the home they loved during World War II. People today also choose to live outside the city with mobile homes. These houses come in many sizes and styles. Some are small, while others are large enough to hold several families. You can even find some that are just for pets!

There are two main types for mobile homes. The first type is produced in factories and assembled by workers piece by piece. This happens before the product can be delivered to the customer. You could also make your own mobile home. First, you'll need to determine the size you would like and whether it should have electricity, plumbing or a stove. You'll also need to make sure that you have enough materials to construct your house. Finally, you'll need to get permits to build your new home.

These are the three main things you need to consider when buying a mobile-home. You might want to consider a larger floor area if you don't have access to a garage. Second, if you're planning to move into your house immediately, you might want to consider a model with a larger living area. You should also inspect the trailer. You could have problems down the road if you damage any parts of the frame.

Before buying a mobile home, you should know how much you can spend. It's important to compare prices among various manufacturers and models. You should also consider the condition of the trailers. Many dealerships offer financing options but remember that interest rates vary greatly depending on the lender.

You can also rent a mobile home instead of purchasing one. Renting allows you the opportunity to test drive a model before making a purchase. Renting isn't cheap. Renters usually pay about $300 per month.