If you have a 100k investment and are looking for an option that provides a passive income and predictable returns, consider real estate investment. Real estate investments offer the opportunity to earn huge equity, with little or no effort. You can invest in a million dollar house with a down payment of only 100k, and build huge equity over time.

Real estate is the best investment

Real estate is the best way to invest a large sum of money. Real estate is a great investment option that can generate substantial cash flow every year and also provides a solid personal asset to the next generation. Real estate is an excellent option if you are looking to diversify your portfolio.

IRAs offer passive investment options

An IRA is a great option for 100k investment and offers tax benefits. It allows you more freedom than a standard 401(k), and offers the opportunity to invest in stocks as well ETFs and other asset types. With the right investment strategy, you can grow your investment over the long term, while taking advantage of tax advantages.

Mutual funds

You should choose the right type of funds if you have $100k to invest. Investing in stocks can be risky, especially if you're not careful. Bonds are safer. These bonds have lower returns but you will earn less. Your age and general health are important factors to consider. Also, think about how long you can afford to keep your money in one place for five to ten years.

ETFs

If you want to invest $100 000, it is worth considering switching to mutual funds or exchange traded funds. These passive investments don't have high fees and can be set to automatically place recurring funds over time. ETFs have many benefits over individual stocks. The barrier to entry is low, making them one of the most preferred investing strategies.

DIY SIPPs

Before you make your first 100k investment in a DIY SIPP, here are some things to keep in mind. First, choose an investment platform. Also, decide how much money you are willing to invest. If you'd like to invest in Vanguard funds, for example, you can look into their SIPP. If you don't want to invest in Vanguard funds, consider looking into SIPPs offered by Hargreaves Lansdown (or Fidelity).

The tax benefits of investing in a retirement plan (401(k),)

There are many tax benefits when you invest in a 401k account. The first benefit is that it's tax-deferred, which means your money grows tax-deferred until you withdraw it at retirement. This tax deferral benefit can be applied to traditional and Roth Roth 401 (k) accounts.

FAQ

How long does it take for a mortgage to be approved?

It is dependent on many factors, such as your credit score and income level. It typically takes 30 days for a mortgage to be approved.

What are the benefits associated with a fixed mortgage rate?

Fixed-rate mortgages lock you in to the same interest rate for the entire term of your loan. This will ensure that there are no rising interest rates. Fixed-rate loans come with lower payments as they are locked in for a specified term.

What are the chances of me getting a second mortgage.

However, it is advisable to seek professional advice before deciding whether to get one. A second mortgage is often used to consolidate existing loans or to finance home improvement projects.

How many times can my mortgage be refinanced?

This depends on whether you are refinancing with another lender or using a mortgage broker. You can refinance in either of these cases once every five-year.

How long does it take to sell my home?

It depends on many factors, such as the state of your home, how many similar homes are being sold, how much demand there is for your particular area, local housing market conditions and more. It can take from 7 days up to 90 days depending on these variables.

Is it better to buy or rent?

Renting is typically cheaper than buying your home. It's important to remember that you will need to cover additional costs such as utilities, repairs, maintenance, and insurance. The benefits of buying a house are not only obvious but also numerous. For example, you have more control over how your life is run.

What are the downsides to a fixed-rate loan?

Fixed-rate mortgages tend to have higher initial costs than adjustable rate mortgages. If you decide to sell your house before the term ends, the difference between the sale price of your home and the outstanding balance could result in a significant loss.

Statistics

- It's possible to get approved for an FHA loan with a credit score as low as 580 and a down payment of 3.5% or a credit score as low as 500 and a 10% down payment.5 Specialty mortgage loans are loans that don't fit into the conventional or FHA loan categories. (investopedia.com)

- Some experts hypothesize that rates will hit five percent by the second half of 2018, but there has been no official confirmation one way or the other. (fortunebuilders.com)

- Private mortgage insurance may be required for conventional loans when the borrower puts less than 20% down.4 FHA loans are mortgage loans issued by private lenders and backed by the federal government. (investopedia.com)

- This means that all of your housing-related expenses each month do not exceed 43% of your monthly income. (fortunebuilders.com)

- Over the past year, mortgage rates have hovered between 3.9 and 4.5 percent—a less significant increase. (fortunebuilders.com)

External Links

How To

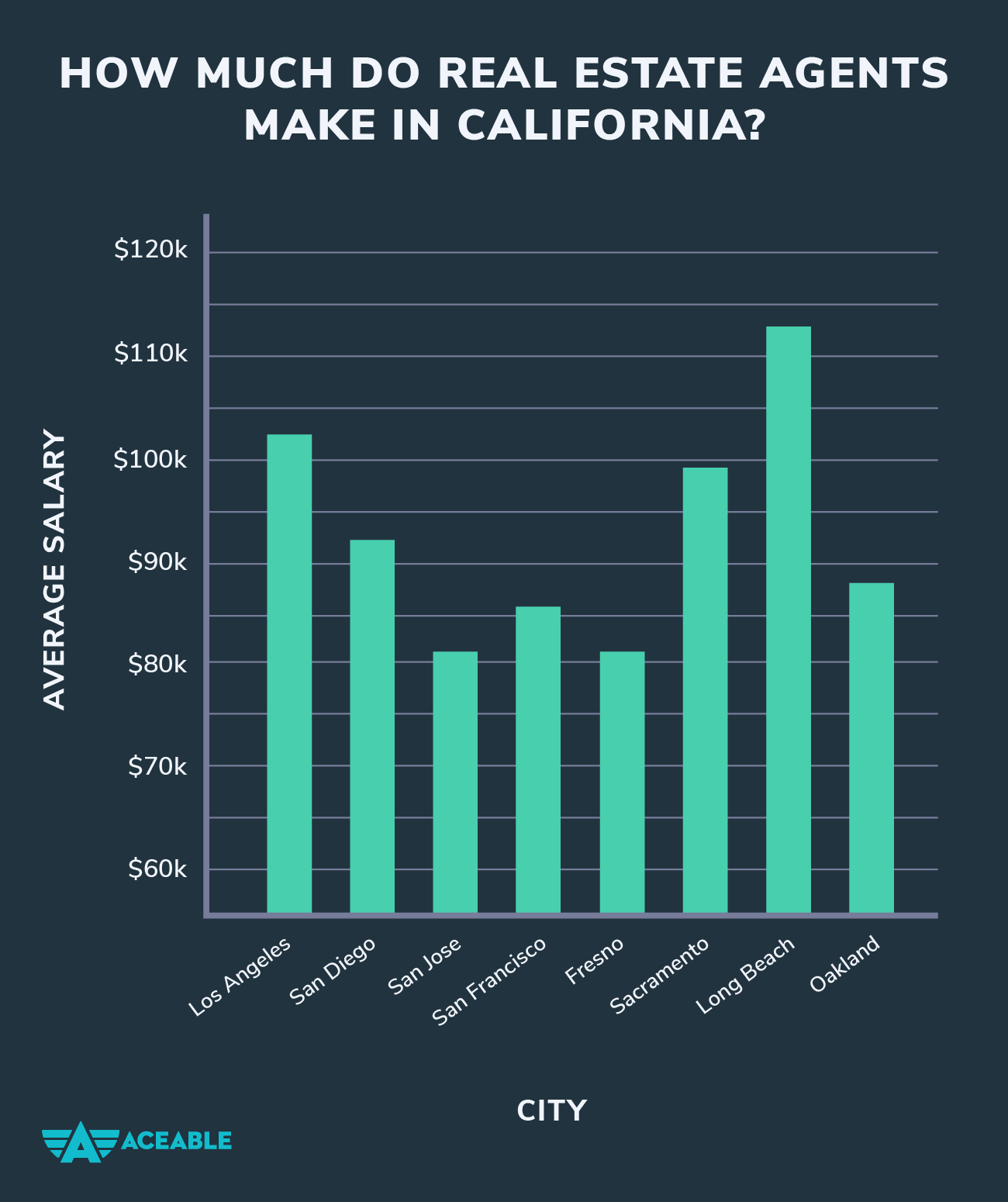

How to become an agent in real estate

Attending an introductory course is the first step to becoming a real-estate agent.

The next step is to pass a qualifying examination that tests your knowledge. This involves studying for at least 2 hours per day over a period of 3 months.

This is the last step before you can take your final exam. For you to be eligible as a real-estate agent, you need to score at least 80 percent.

You are now eligible to work as a real-estate agent if you have passed all of these exams!